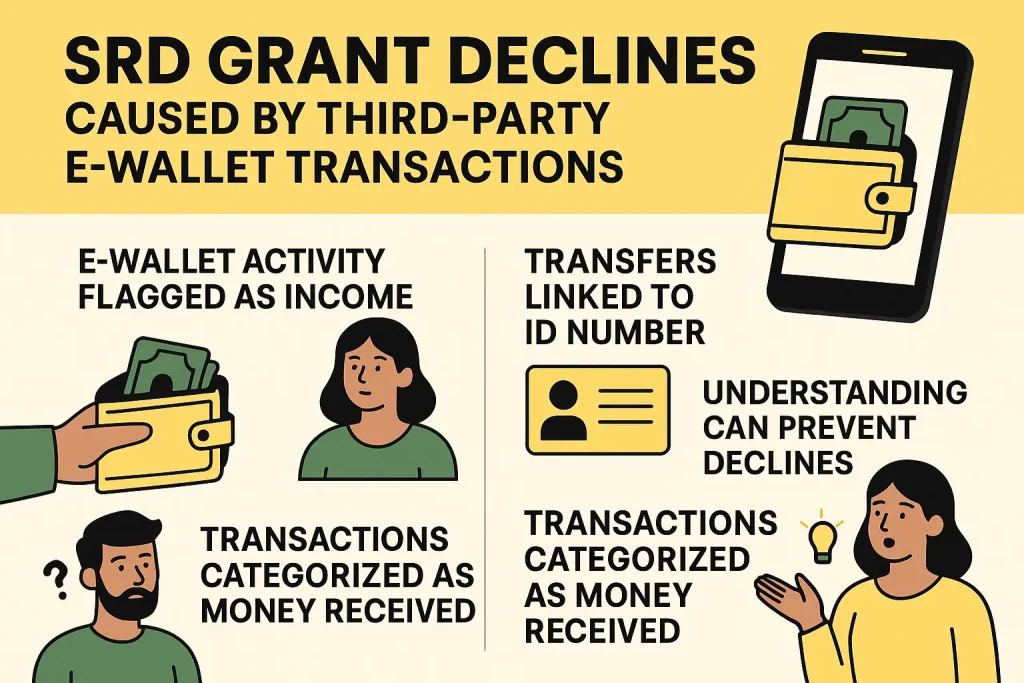

SRD Grant Declines Caused by Third-Party E-Wallet Transactions

In 2025, one of the most misunderstood reasons behind SRD grant declines when you perform SASSA Status Check is linked to third-party e-wallet and digital money transfer activity. Many people assume that SRD eligibility is only affected by formal bank deposits or income sources.

However, with South Africa’s rapid shift toward digital financial platforms, a new pattern has emerged: any transaction tied to your ID number even through an informal wallet may be flagged as income.

This problem remains largely undocumented publicly, yet thousands of beneficiaries are experiencing unexplained declines every month. Understanding how these digital systems interact with SASSA’s verification tools is key to preventing repeated disqualification.

Reasons

Verification System

The SRD verification engine expanded significantly in 2025. Instead of relying solely on traditional banking records, the system now reviews various financial platforms to detect potential income. These include:

- Retail store wallets

- Mobile app money transfers

- Digital vouchers

- Third-party wallet top-ups

- Instant cash-send services linked to an ID

When a family member sends money through these platforms even in small amounts the system sees financial activity and may categorize it as income.

Account’s Transactions

Even if the sender simply uses your ID number for verification, the system can read that digital trace. This applies to:

- Electricity voucher reimbursements

- Grocery top-up payments

- Emergency cash sent via store money counters

- Mobile wallet “SendMoney” features

None of these are actual income, but they appear in the system as money received, which influences the automated decision-making.

Why This Issue Is So Confusing for Beneficiaries

Many people who get declined genuinely have no job or source of income. Their confusion often stems from the fact that they received only small, once-off support transfers. Yet the system does not differentiate between:

- A R100 grocery gift

- A R250 debt repayment

- A once-off electricity contribution

- A R500 income payment

All are interpreted the same way.

The SRD decline message never specifies which transaction caused the issue. This lack of transparency leaves beneficiaries without a clear explanation, making the problem feel impossible to resolve.

Who Is Most Affected by This Problem?

- Beneficiaries in Informal or Cash-Based Households: People who depend on family members for small contributions are often unaware that these transfers count as digital activity.

- Individuals Without Bank Accounts: Many rely on store wallets, retail counters, or mobile wallets. These platforms are now part of the verification checks.

- Applicants Using Shared Phones or IDs for Convenience: If someone uses your ID to collect or send money, the system may read that as your transaction.

How to Avoid SASSA Declines

- Although the system’s internal criteria aren’t publicly detailed, beneficiaries can take practical measures:

- Avoid Receiving ID-Linked E-Wallet Transfers: Encourage supporters to use cash-based assistance when possible.

- Keep Your Financial Footprint Simple: Using multiple wallets or digital platforms increases the likelihood of misinterpretation.

- Monitor All Digital Transactions Carefully: Even small monthly activity may cause automated declines.

- Clarify Situational Needs During Appeals: If you appeal, explain the purpose of the transfer clearly.

Why This Issue Needs Public Awareness

Digital wallet usage is rising across South Africa, especially among people without bank accounts. But as these tools expand, the verification systems adjust without public explanation. This creates a gap between everyday financial reality and automated grant evaluations.

Understanding this issue early helps applicants avoid unnecessary declines and maintain grant continuity.