No Money In Bank Still SRD 370 Status Shows Alternative Income | How To Fix

Few SASSA Status Check messages create more anger and confusion than seeing your SRD R370 application declined for “alternative income source” when you genuinely have no job, no salary, and no regular income. Unfortunately, most explanations online oversimplify the problem and quietly suggest that applicants are at fault.

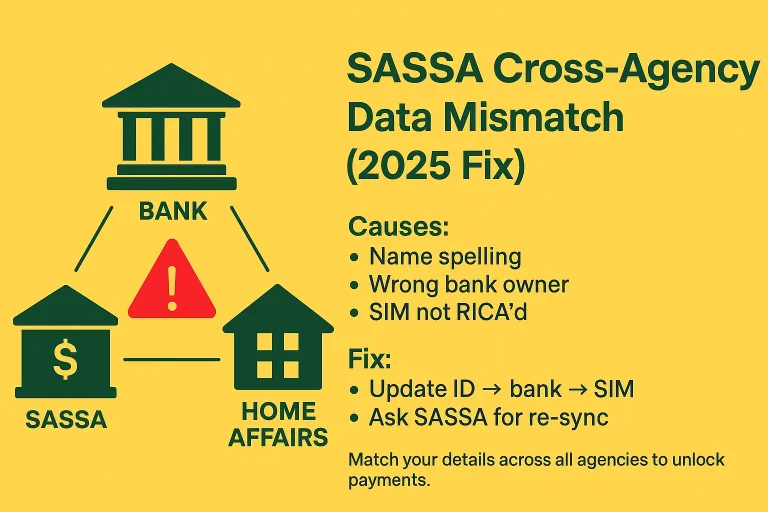

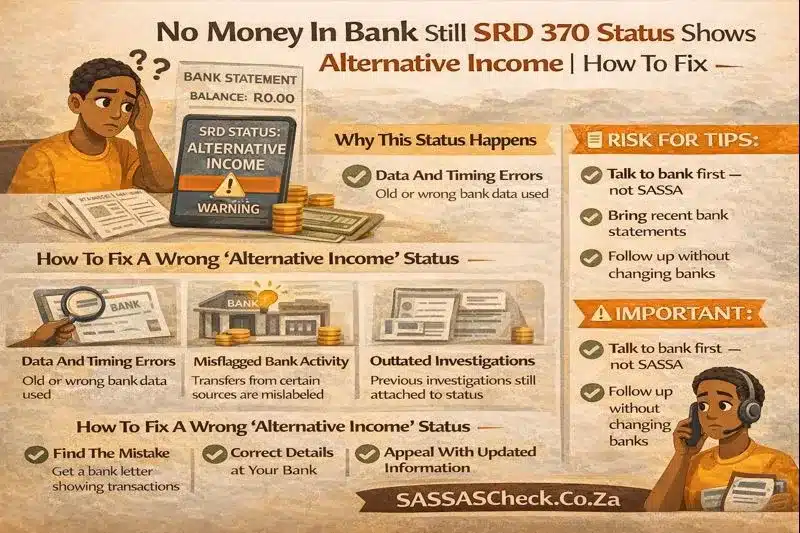

In reality, alternative income declines are system-driven decisions, not personal accusations. The system does not check your life circumstances the way a human would. Instead, it reads data signals, patterns, and financial movements that often do not represent real income at all. Understanding how this happens is essential when dealing with the South African Social Security Agency and avoiding repeated declines.

What “Alternative Income Source” Actually Means

When SASSA flags alternative income, it does not mean you are employed or earning a salary. It means the system detected financial activity linked to your identity during the assessment period. This activity can come from multiple sources and does not always reflect money you can live on or rely on.

The system works on strict rules. If money appears in your linked records, even once, it may be treated as income unless proven otherwise. The system does not ask whether the money was temporary, borrowed, or intended for someone else. It simply records that funds were present.

This is why many unemployed applicants are shocked by the decline.

Common Reasons

Once-Off Bank Deposits

A single deposit into your bank account can trigger an alternative income flag. This includes money sent by family members, friends, or community support. Even if the money was for food, transport, or emergencies, the system does not understand context.

If the deposit falls within the assessment window, the system may treat it as income, even when it was never recurring.

NSFAS Transaction

Many applicants are declined because of past or partial student funding records. Even if you are no longer studying or receiving funds, historical data can still be detected during reassessments.

In some cases, the system reads funding approval as income, even when no payment was received during that month.

Temporary Assistance from Employers or NGOs

Short-term payments, stipends, or relief funds can trigger income flags. These payments are often meant to help during hardship, but the system records them as income regardless of duration. Once flagged, the decline may repeat across multiple months until reassessment clears it.

Why the Decline Keeps Repeating Monthly

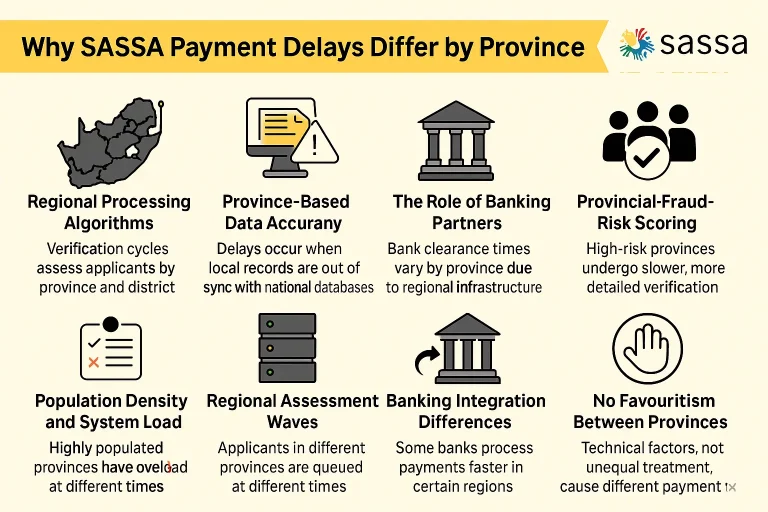

Many applicants notice that once they are declined for alternative income, the same reason appears every month. This happens because the system relies on rolling data windows.

If a financial signal appears once, it can affect multiple assessment cycles. The system does not automatically forget income signals immediately after one month. It reassesses using overlapping timeframes, which means a single deposit can affect several months. This creates the impression of permanent decline, even when the situation has already changed.

Why Reapplying Rarely Fixes This Problem

Reapplying does not reset income data. Each application pulls from the same linked systems and financial records. If the data causing the decline still exists in the system, the new application will produce the same result.

This is why many people reapply repeatedly with no change. The system sees the same signals and reaches the same conclusion. Reapplication can sometimes make things worse by delaying reassessment cycles.

What You Should Do Instead of Reapplying

The most effective approach is waiting for reassessment cycles to pass naturally. As older financial signals age out of the system, eligibility may restore automatically. Keeping your banking activity stable during this time is critical. Avoid unnecessary deposits if possible, as new activity can restart the decline cycle.

Monitoring your status monthly without changing details allows the system to complete clean reassessments.

When Alternative Income Declines Resolve Naturally

Many alternative income declines resolve after one to three months, depending on the type of income signal detected. Temporary deposits and once-off payments are the most likely to clear.

Longer delays usually occur when historical records or linked funding systems remain active. Even then, resolution often happens without intervention once the system refreshes data.

Common Misunderstandings That Cause Panic

Applicants often believe that:

- Someone falsely reported income in their name

- Their identity was used fraudulently

- SASSA permanently blacklisted them

In most cases, none of these are true. The system is conservative by design and prefers declining rather than risking overpayment. Understanding this reduces unnecessary fear and frustration.

When You Should Take Action

Action becomes reasonable when:

- The same decline reason persists beyond three consecutive months

- No banking activity has occurred for a long time

- A new income reason appears unexpectedly

At this stage, formal clarification may help, but it should only be done after allowing normal reassessment cycles to complete.

Final Reality Check

An alternative income decline does not mean you are dishonest or ineligible forever. It means the system detected financial activity it could not interpret correctly.

The SRD system prioritises caution over context. While this causes frustration, it also means many declines resolve once data signals fade. Understanding how the system works protects you from unnecessary actions that silently extend delays.

FAQs

Yes. Many cases resolve automatically once older data is no longer considered.