South Africa Weighs a Standalone “Crypto Gains Tax” for the 2026 Budget

In early August 2025, a lively conversation among South African finance commentators on X (Twitter) Spaces reignited a long-running question: should crypto profits be taxed under a clear, standalone regime?

According to multiple participants, including former policy analysts, a discussion paper circulating in policy circles is exploring a “Crypto Gains Tax” (CGT) framework separate from the classic capital gains provisions.

Although nothing is official, the conversation has quickly gained traction across crypto and tax community threads, with several contributors suggesting the National Treasury is considering draft options for the 2026 Budget cycle.

Why a Separate Crypto Regime Is on the Table

South Africa already taxes crypto gains in principle, but practitioners complain about ambiguities: how to treat staking rewards and airdrops; whether token-for-token swaps are disposals; how to substantiate cost basis for coins moved between wallets; and when to recognize income versus capital.

A separate schedule could tidy up these issues, create uniform record-keeping expectations, and synchronize crypto reporting with AML/KYC checks.

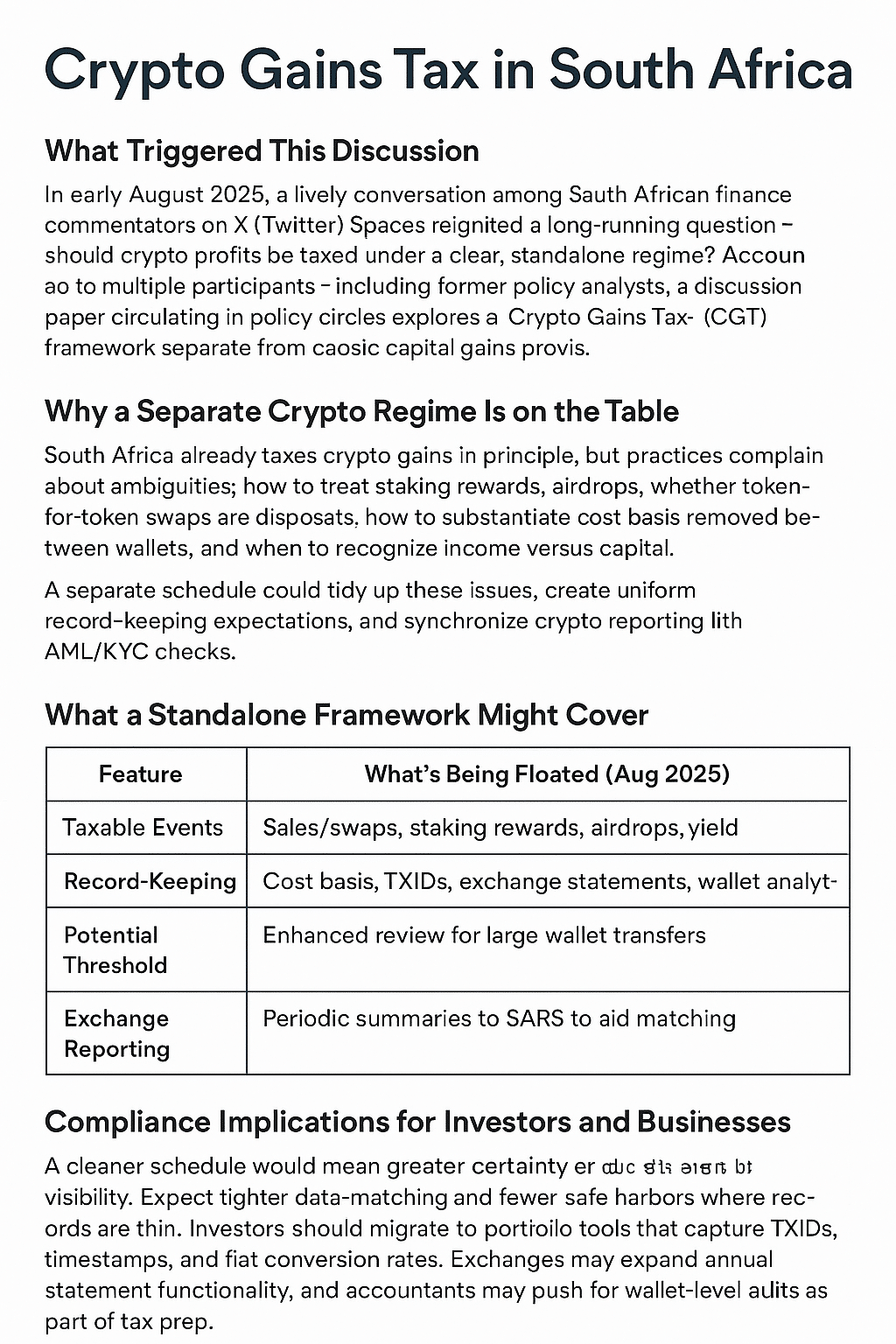

What a Standalone Framework Might Cover

The chatter suggests a broadened list of taxable events, including disposals (sales, swaps), staking rewards, yield from liquidity pools, and value received from airdrops. Freelancers paid in crypto would be expected to recognize income at the rand value on receipt, not only at conversion.

Reporting and Thresholds

A recurring theme is the flagging of wallet transfers above a fixed rand value for enhanced review, alongside periodic summaries from local exchanges to SARS. The aim is to narrow the gap between on-chain activity and tax declarations.

Alignment With Existing Taxes

Expectations are that standard VAT rules would still apply to businesses supplying taxable services for crypto, while the proposed CGT schedule would primarily define income vs. capital, disposal mechanics, and documentation.

| Feature | What’s Being Floated (Aug 2025) |

|---|---|

| Taxable Events | Sales/swaps, staking rewards, airdrops, yield |

| Record-Keeping | Cost basis, TXIDs, exchange statements, wallet analytics |

| Potential Threshold | Enhanced review for large wallet transfers |

| Exchange Reporting | Periodic summaries to SARS to aid matching |

Compliance Implications for Investors and Businesses

A cleaner schedule would mean greater certainty but also greater visibility. Expect tighter data-matching and fewer safe harbors where records are thin. Investors should migrate to portfolio tools that capture TXIDs, timestamps, and fiat conversion rates. Exchanges may expand annual statement functionality, and accountants may push for wallet-level audits as part of tax prep.

What to Watch Next

Look for references to crypto in pre-Budget consultations and any calls for comment on digital-asset taxation. If Treasury takes this forward, a discussion paper could emerge later in 2025, followed by a more formal process in early 2026.