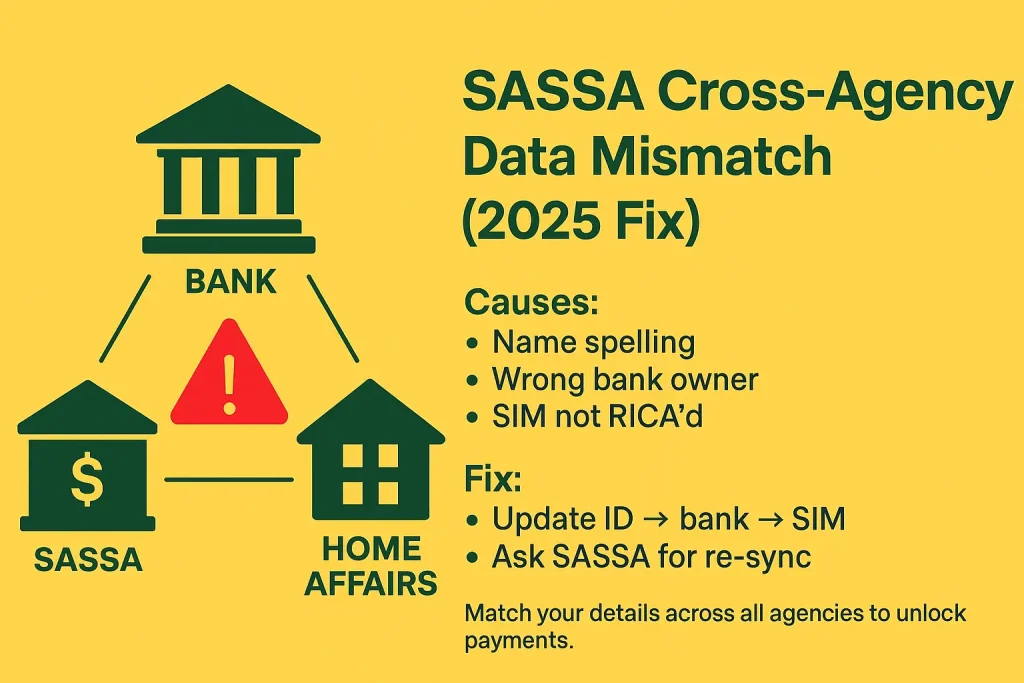

SASSA Cross-Agency Data Mismatch After 2025 Integration (Full Fix Guide)

In 2025, SASSA rolled out a major cross-agency integration upgrade. Your ID, banking details, SIM registration, and other records are now checked against multiple government and financial databases.

Because of this, many applicants are suddenly seeing “data mismatch” or “cross-agency conflict” errors on the SASSA or SRD portal. This guide explains what the error means, why it happens, and how to fix it step by step.

What Is Cross-Agency Data Mismatch?

A cross-agency data mismatch happens when the information SASSA has for you does not line up with information stored by other institutions it now checks against, such as:

- Department of Home Affairs (DHA)

- Bank KYC records

- RICA SIM registration

- SARS or other government systems

- Credit and fraud-prevention databases

When the system detects inconsistent details, your profile may be flagged and your:

- Application status may stay “Pending”

- Payment may be delayed or blocked

- Re-evaluation may not complete

Reasons

Name or Surname Spelled Differently

If your full name on SASSA is not exactly the same as on:

- Your ID document

- Bank account

- SIM registration.

Example:

- SASSA: Thabo M Ndlovu

- Bank: Thabo Marcus Ndlovu

- DHA: Thabo Ndlovu

Even a small difference can trigger a conflict.

Old or Incorrect ID Number

Sometimes a bank, previous employer, or old record has an incorrect ID digit or an outdated profile attached to your name. When SASSA checks that, you get flagged.

Bank Account Not in Your Own Name

For 2025, SASSA’s fraud engine is stricter about account ownership. If the payment account is:

- In a relative’s name

- A joint account not clearly linked to you

- A wallet or fintech profile under a different ID

SIM Card Not RICA’d in Your Name

If your SASSA number is not RICA-registered under your own ID, the integration may show a conflict between mobile and identity data.

Recent Changes Not Yet Synced

If you recently:

- Changed your surname

- Updated your ID details at Home Affairs

- Switched banks or opened a new account

How to Fix

Confirm Your Official ID

Your DHA record is the “master” record. Everything else must match this.

- Check that:

- Full names and surname are correct

- ID number is active and valid

- No duplicate profile exists

- If there’s an error, ask DHA to correct it and keep proof of the change.

Align Your Bank Account Details With Your ID

Log in to your banking app or visit a branch and check:

- Name on account matches ID exactly

- Surname spelling and initials are the same

- Your ID number on the bank’s system is correct

If necessary:

- Ask your bank to update your personal details

- Request proof of account with the corrected information

- Avoid using someone else’s account for SASSA

Then, on the SASSA portal:

- Go to Change Banking Details

- Re-enter your bank info using the same exact names and ID as DHA

- Confirm via OTP/SMS

Fix Your RICA / SIM Information

For your SASSA cellphone number:

- Ensure the SIM is RICA’d in your own ID number

- If not, visit the network store and update the RICA registration

- Avoid using a friend’s or family member’s number for SASSA

Once updated, double-check that your SASSA profile has the same number.

Duplicate Profiles

If you previously:

- Applied with a different email or number

- Opened multiple profiles on different devices

- Used old names or partial initials

Try to:

- Use one consistent profile

- Log in only with your main number and ID

- Avoid re-registering from scratch unless instructed by SASSA

Contact SASSA

Once you’ve corrected your details, ask SASSA to manually refresh and re-sync your data:

- Call Centre: 0800 60 10 11

- WhatsApp Self-Service: 082 046 8553

- Local SASSA office (take ID, bank proof, and RICA slip)

Tell them:

“My application is flagged for cross-agency data mismatch. I have updated my Home Affairs, bank, and RICA details. Please trigger a manual re-sync.”

They may escalate your case for manual verification.

How Long Does It Take

Timeframes vary, but typically:

- 1–3 working days after all systems match

- Up to 7 working days if manual intervention is needed

- Longer if Home Affairs or bank records still show old information

If your status doesn’t change after a week, follow up with SASSA and your bank.

Tips to Prevent Future Cross-Agency Conflicts

- Use one consistent version of your full name everywhere

- Keep your SASSA, bank, and RICA details updated at the same time

- Avoid changing numbers or accounts during re-evaluation periods

- Keep documents like proof of residence and bank letters ready

- Immediately correct any spelling mistakes you notice in any system

FAQs

My SASSA status says “data mismatch” but my info looks correct. What now?

Sometimes the problem is in an external system (bank, RICA, old employer records). Confirm your details with Home Affairs and your bank first, then contact SASSA and request a manual re-sync.

Can I still get paid while there’s a data mismatch?

Usually no. The system must be satisfied that all records match before payments are released. Once the mismatch is cleared and your status moves to approved with pay date, payment should follow via your chosen method.

I’m using my mother’s bank account. Is that a problem?

Yes. In 2025, SASSA is stricter about account ownership. Payments should go into an account or wallet in your own name and ID. Using someone else’s account is a common cause of mismatches and blocked payments.

Does changing my phone number affect cross-agency checks?

It can. If your new SIM is not RICA’d in your own name, or if SASSA still has your old number on file, the system may flag your profile. Always RICA the number under your ID and update it on the SASSA portal.

How often does SASSA refresh cross-agency data?

The system runs automated refresh cycles multiple times per day. However, when major changes occur (name change, new bank account, new ID record), it can take a few days for all systems to be fully aligned. Manual intervention speeds this up.